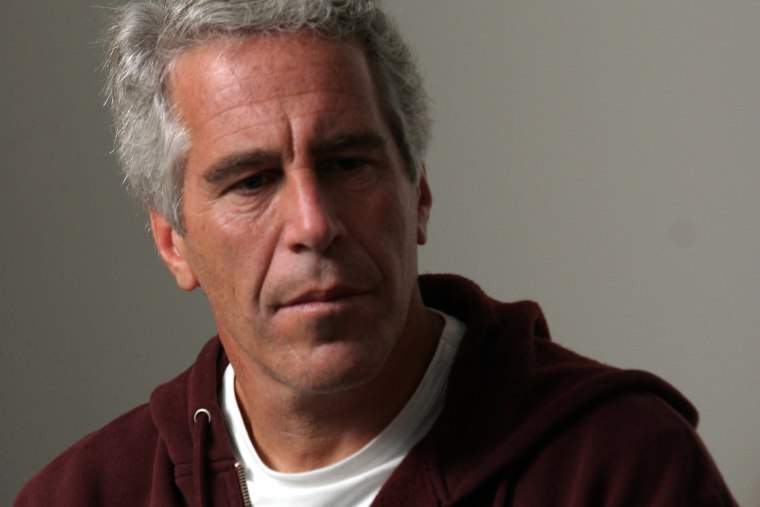

JPMorgan Chase is seeking documents from Manhattan District Attorney Alvin Bragg’s office in lawsuits the bank faces over its relationship with the late convicted sex offender Jeffrey Epstein, a former client, according to federal court records.

Attorneys for Bragg, JPMorgan Chase; a former senior executive, Jes Staley; and the plaintiffs in the cases attended a telephone conference before U.S. District Judge Jed S. Rakoff on Tuesday. Rakoff instructed Bragg’s office to provide a so-called privilege log relating to documents sought by the Wall Street giant by Friday. That’s a list of documents Bragg’s office argues are privileged and not subject to discovery.

A spokesperson for Bragg said, “A protective order is in place, so we cannot comment on the nature of the requested documents.”

JPMorgan Chase didn’t immediately respond to a request for comment.

The bank faces two lawsuits, filed last year by the U.S. Virgin Islands and a woman identified as “Jane Doe 1,” accusing it of having facilitated Epstein’s sex-trafficking enterprise.

“JPMorgan knowingly, negligently, and unlawfully provided and pulled the levers through which recruiters and victims were paid and was indispensable to the operation and concealment of the Epstein trafficking enterprise,” the U.S. Virgin Islands alleged in its complaint.

The two suits seek monetary damages. JPMorgan Chase has denied liability.

Deutsche Bank agreed Wednesday to pay $75 million to Epstein victims to settle a lawsuit claiming it enabled Epstein’s conduct.

JPMorgan Chase sued Staley in March, claiming he should be held liable for damages it might face from the lawsuits. It accuses Staley — who worked at the bank for more than 30 years — of knowing about Epstein’s conduct and engaging in “sexual activity with young women procured by Epstein.”

Staley asked for the lawsuit to be dismissed and said the bank is using him as a “public relations shield.” However, he has expressed regret for his relationship with Epstein.

JPMorgan Chase CEO Jamie Dimon is scheduled to be deposed in the lawsuits this month.

In a Bloomberg television interview last week, Dimon said he is “so sad that we had any relationship to that man whatsoever.”

“You know, we had top lawyers evaluating, from the [U.S. Securities and Exchange Commission] enforcement, the [Justice Department], you know, and obviously, had we known then what we know today, we would have done things differently,” Dimon said. “But it’s very unfortunate, and I have deep respect for these women.

“That doesn’t mean we’re liable for the action of an individual,” he added, “but I do have deep respect for them. My heart goes out to them.”

On Thursday evening, a JPMorgan spokesman told NBC News: “Jamie Dimon never met Epstein, never communicated with him, never emailed with him, and never played a role in any business with him.”

In court documents, the U.S. Virgin Islands has alleged that the company’s “banking relationship” was known at the “highest levels of the bank.” An August 2008 internal email says, “I would count Epstein’s assets as a probable outflow for ’08 ($120mm or so?) as I can’t imagine it will stay (pending Dimon review).”

Additional internal emails and memos filed as exhibits also revealed that bank executives had been worried about the financial institution’s relationship with Epstein dating to 2006.

Financial records showed Epstein used his JPMorgan Chase accounts to transfer around $3 million to “women and girls” from 2003 to 2013, according to records the plaintiffs filed as exhibits.

The financial records do not disclose the names of those who received the transfers or their connections to Epstein.

During that time, Epstein withdrew a little over $5 million in cash, typically in amounts of $40,000, court documents show.

Meanwhile, Sen. Tina Smith, D-Minn., a member of the Banking, Housing and Urban Affairs Committee, asked Dimon in a letter last week why the bank ignored “obvious signs of Epstein’s illegal activity” and maintained a relationship with Epstein.

“If true, JPMorgan’s decision to turn a blind eye to such egregious misconduct raises serious questions about its role in facilitating Epstein’s abuse, and its willingness or ability to root out and prevent other, less apparent instances of sex trafficking,” she said.